Fears of recession are easing for Minnesota manufacturers, and many have returned to grappling with the normal aches and pains of operating a business. But that doesn’t mean they are bullish on the state’s economy. Manufacturers of all sizes anticipate a near future of economic stagnation, coloring their decisions about hiring and investing in their companies.

Find complete survey results and information on the State of Manufacturing page.

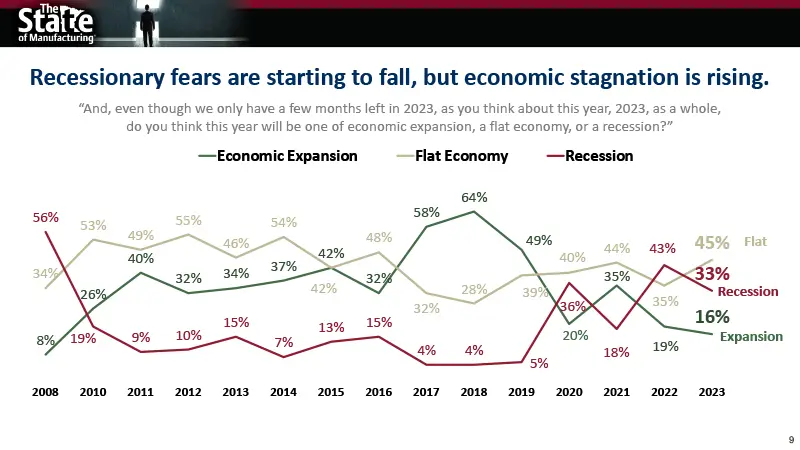

Pair that with deep worry about the changes enacted by the Minnesota Legislature in 2023 — notably requirements to provide paid family and medical leave and paid earned sick and safe leave. All told, these conditions have fostered a prevailing mood of uncertainty and trepidation among manufacturers. Enterprise Minnesota’s 15th annual survey, the State of Manufacturing® (SOM), found that just 16% of respondents believe that 2023 will be one of economic expansion. This is the lowest level since the rock bottom 8% recorded during the 2008 Great Recession.

“There’s no confidence right now that the economy is growing,” says Rob Autry, founder of Meeting Street Insights, a South Carolina–based survey research company that has conducted the SOM survey since its start in 2008. “That could explain why so many manufacturers are apprehensive about hiring. They are skittish.”

The pollster annually surveys 400 manufacturing executives statewide and an oversampling of 50 executives in each of the six McKnight Initiative Foundation regions, revealing the latest trends in key business areas including growth, workforce, supply chain, economic confidence, and more. Respondents represent a broad mix of manufacturers by region, employee count, and annual revenue, who provide insight into the state’s economic engine.

A random sample of Minnesota manufacturing executives participate in the telephone survey, including owners, CEOs, CFOs, COOs, presidents, vice presidents, and managing officers. It has a margin of error of ±4.9%. Enterprise Minnesota also pairs its SOM polling research with 12 focus groups held in the fall to gain deeper understanding from manufacturing leaders.

Legislative sea change

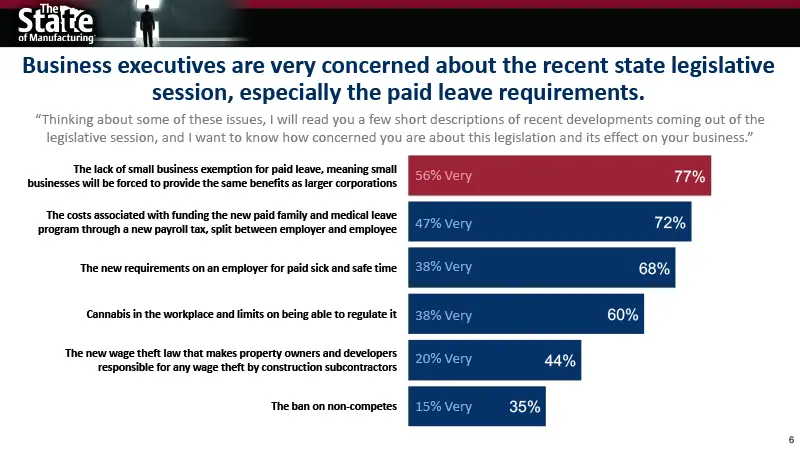

Through these meetings, manufacturers illuminated their deep anxiety about new requirements that the Minnesota Legislature placed on companies of all sizes. Especially worrying to executives is the lack of a small business exemption for paid family and medical leave, with more than three-fourths (77%) noting that they are very concerned.

“It struck me how concerned Minnesota manufacturers are with what’s been happening at the State Capitol and the impact it will have on their businesses,” Autry says. “We haven’t seen that level of anxiety and concern about what’s going on in St. Paul traditionally.”

In addition, 72% of respondents are very concerned about the costs associated with the new payroll tax, split between employer and employee, to fund the paid leave program. Add in 68% who are very concerned about new requirements for paid sick leave, plus 60% who are very concerned about cannabis in the workplace and limits on being able to regulate it. Combined, this makes for a highly unsettled sector.

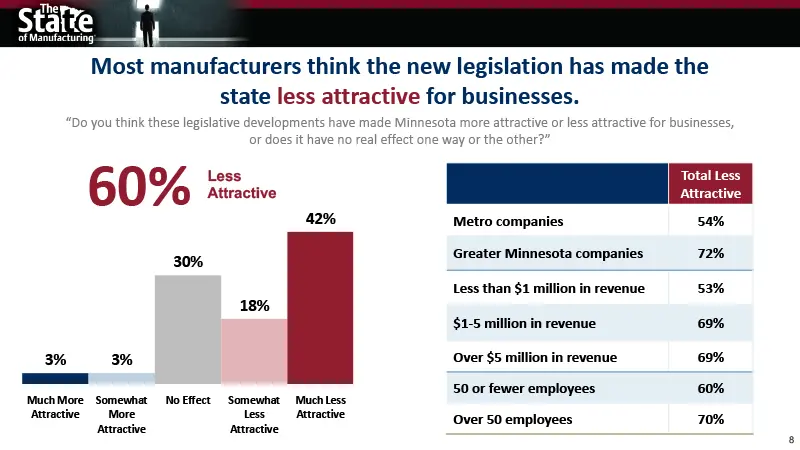

Manufacturers believe that these new regulations contribute to Minnesota becoming a less attractive business climate. In total, 59% reported that the new legislation makes the state less attractive for business, including 42% who say it is much less attractive.

These changes are prompting mixed reactions. In focus groups, some manufacturers shared that they are creating jobs in other states with better business climates or waiting on making new hires. Others note the difficulty of moving an entire manufacturing operation and dozens of employees to a new state, making leaders resigned to the changes, says Bob Kill, president and CEO of Enterprise Minnesota.

“They are still trying to figure out what these new regulations mean for them. It adds more uncertainty” in a time where conditions are already difficult with hiring struggles, high inflation, and supply chain issues, Kill says. “It’s really a huge burden for the smallest manufacturers.”

On shaky ground

Looking to 2024, manufacturers are mixed about the near-term economy they will face. Fears of a recession have dropped 23%, from 43% worried about it in 2022 to 33% this year. But that doesn’t mean they are predicting a bright and shiny future. When asked their views about whether economic stagnation is on the horizon, 23% more believe that they will be facing a flat economy. In 2022, 35% foresaw a flat economy while 43% expect a flat economy in 2023.

Looking ahead, manufacturers predict that the biggest challenges that could put a damper on growth are attracting and retaining a qualified workforce (39%), inflation (32%), and increases in costs of materials needed to make products (31%).

Still, manufacturers are confident about the future, with 85% sure that they could withstand an economic downturn in the next year. When considering their companies’ financial future, 86% of manufacturers feel confident. There has been slow and steady improvement in confidence since the pre-pandemic peak of 93% in 2019 and subsequent drop to 85% in 2020.

The smallest manufacturers, with 50 or fewer employees and those with less than $1 million in revenue, have the lowest confidence in their companies’ future.

2024 worries

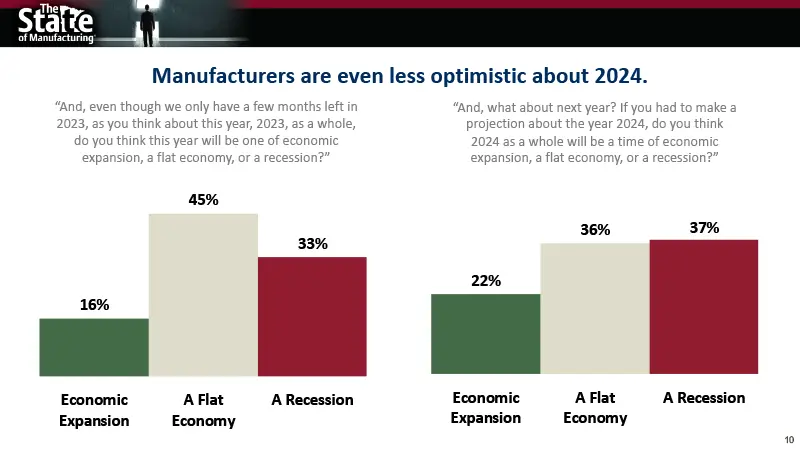

The prevailing sentiment among manufacturers is one of pessimism for the future. A total of 73% project a future flat economy or recession in 2024. However, this is slightly better than how they view the current year, with 78% anticipating a flat economy or recession in 2023. Though usually an optimistic bunch, just 22% of manufacturers believe that 2024 might be a time of economic expansion. Even so, the contingent of those with a sunnier view grew by 38%, gaining from 16% in 2023.

Overall, the Minnesota business climate has gotten worse according to a bigger percentage of manufacturers. The current survey found that 50% believe it is getting worse, an increase from 46% in 2021 and 2022. This year, 34% believe the business climate is the same and 14% think it is better.

“A lack of economic confidence and a real sense that the business climate in the state is at its worst level yet seems to be impacting perceptions of revenue growth and profitability growth this year,” Autry says. “Then add in the legislative piece. Manufacturers are clearly taking a wait-and-see approach.”

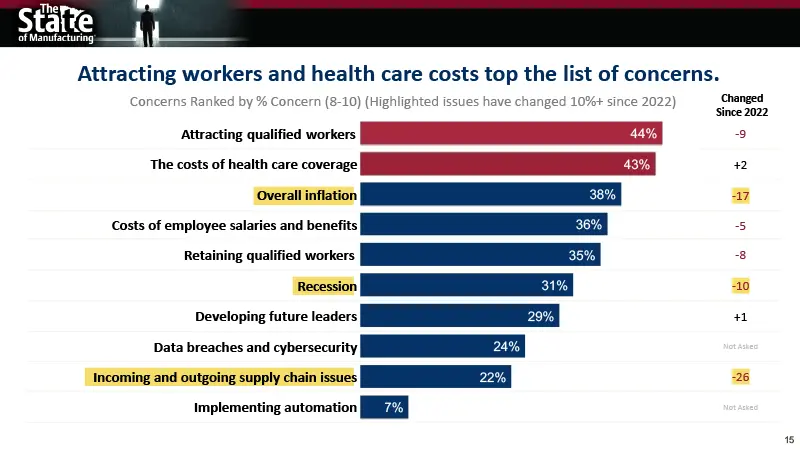

Manufacturers’ top concerns

What gives manufacturers the most heartburn? Their main pain points include attracting qualified workers (44%), the cost of health care coverage (43%), and overall inflation (38%). However, worries about inflation have dropped 17 points since 2022, while concerns regarding health care have increased two points.

Concerns about attracting qualified workers have eased slightly. It declined as a top worry by 9 points since 2022. “One reason is that most communities have experienced layoffs, which then expand the pool of job seekers for other businesses,” Kill says. However, it’s not smooth sailing, with 83% of manufacturers reporting that it is tough to find qualified candidates.

Top worries vary depending on where manufacturers are based and their size. Attracting workers is a struggle particularly in northeastern Minnesota (56%), southwest Minnesota (51%), central Minnesota (49%), and southern Minnesota (47%). Inflation tops the concerns list in northwestern Minnesota (46%) and southern Minnesota (47%). In the Twin Cities region, the rising cost of health care landed in the top heartburn spot at 45%, followed closely by attracting workers at 44%.

For companies with less than $1 million in revenue, the increasing costs of materials needed to make their products and inflation are their two chief worries. Those with revenue between $1 million-$5 million cite attracting and retaining their workforce and increasing costs of materials as their top two. Manufacturers with more than $5 million in revenue highlight attracting and retaining a qualified workforce and inflation as their biggest concerns.

As inflation cooled and hiring pressures eased this year, there has been a noted shift in manufacturers’ operations. “Companies are returning back to making decisions that made more sense before COVID,” Kill says. But even with some conditions improving, “we haven’t gone back to where it’s sailing along with a big strong wind at our back.”

Roadblocks to growth

Overall, manufacturers believe that inflation and attracting and retaining a qualified workforce are the biggest factors that could impact their future growth. The outlook for the economy, the difficulty of finding workers, and the uncertainty of new regulations are combining to suppress hiring.

A majority of manufacturers are not looking to hire, with the smallest companies being the least likely to add employees. And those that are hiring have fewer positions available. Overall, 55% of manufacturers have no open positions, an increase from 47% in 2022 and 38% in 2021.

Manufacturers have put a lid on hiring, even though many acknowledge that onboarding new people is a critical component of future growth (43%). Securing new customers and markets (40%) also is vital, along with boosting productivity (18%).

Stressing training and retention

Instead of trying to hire more people, many manufacturers are emphasizing employee retention. That entails investing in workforce training and development, as well as finding ways to use automation to handle the mundane jobs people don’t really want, Kill says.

“Following COVID, more people want to work someplace where it’s a downright great place to work. That’s becoming more common, along with a focus on retaining key people,” Kill says. “Smart executives know that people doing the mundane jobs would like greater opportunities, and that’s part of retaining people.”

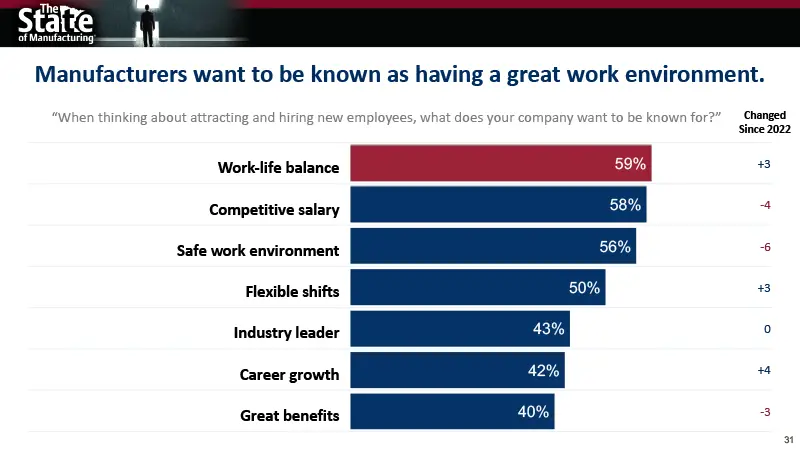

To that end, manufacturers are devoting significant energy to operating companies that are attractive to potential employees. It’s no longer just about having a place to go to work. Manufacturers highlighted several elements that they want their companies to be known for. Providing work-life balance tops the list at 59%, followed by competitive salaries at 58%, and a safe work environment at 56%. These desired characteristics are consistent across manufacturers of all sizes.

Strategic planning on the backburner

An emphasis on planning for the future continues to decline among manufacturers, with only 47% having a formal strategic plan. This is the lowest level since 2016. When it comes to succession planning, 45% report having a set plan compared to 50% in 2022.

Manufacturers also are leaving an important tool unused. Creating formal mission, vision, and values statements coalesce employees around unified goals and prime companies for growth. Yet fewer than 43% report having them. This is especially true of companies with less than $1 million in revenue, with only 17% reporting having a statement.

Find complete results, slide deck, and additional information on the State of Manufacturing page.

…

Featured story in the Winter 2023 issue of Enterprise Minnesota magazine.