State of Manufacturing®

The State of Manufacturing® is the premier annual survey of Minnesota’s manufacturing industry, highlighting the trends, conditions, and outlook of executives from around the state.

Find survey results and upcoming events below.

Register for an upcoming event

Join us as we travel the state, visiting each Initiative Foundation region to host a regional State of Manufacturing event to get a local understanding of the trends shaping manufacturing in each region.

See all of our upcoming State of Manufacturing events

Pollster’s Analysis

The 17th annual State of Manufacturing® survey found manufacturers have deep and persistent concerns about growing regulatory burdens and taxes while feeling better about their own companies’ prospects than they did in 2024.

2025 Survey Results

Feeling Better, Not Bullish

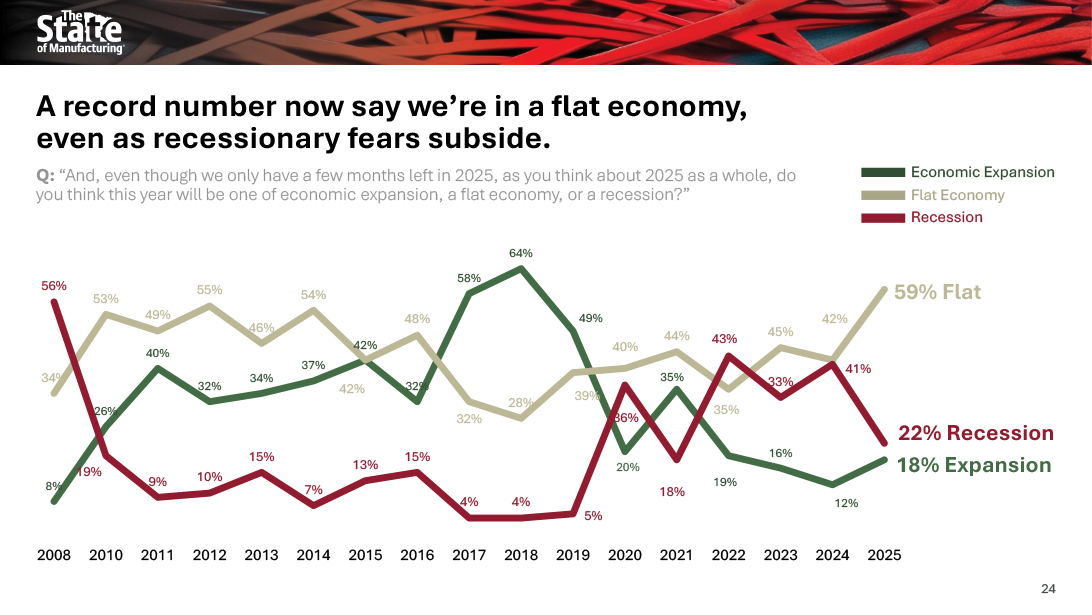

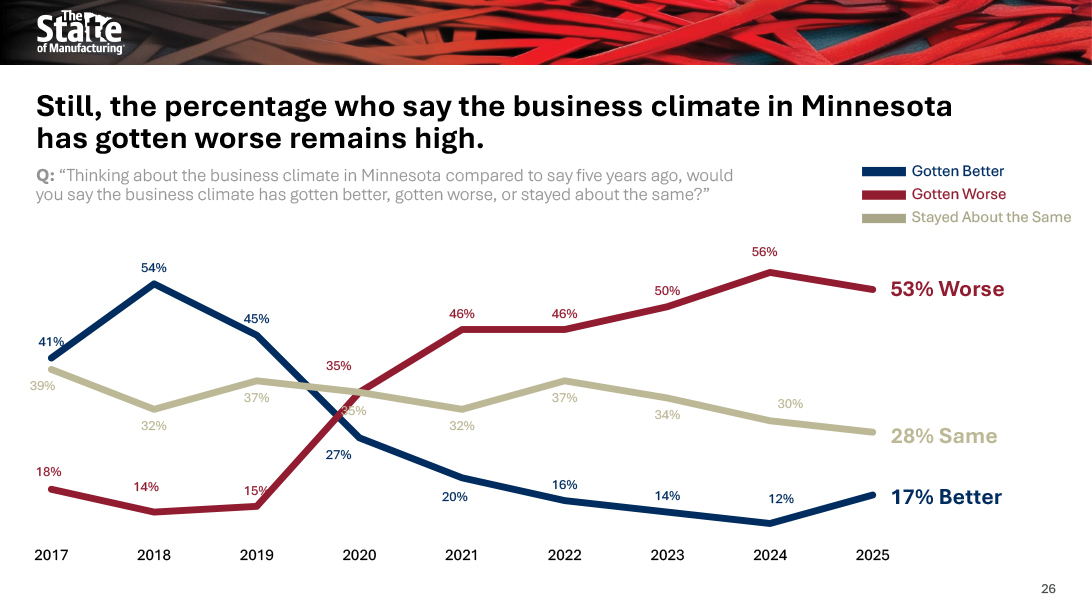

While confidence among manufacturers has improved from 2024 and fears about a recession are down, few see the state’s economy as expanding, and most say Minnesota’s business climate is worse today than it was five years ago.

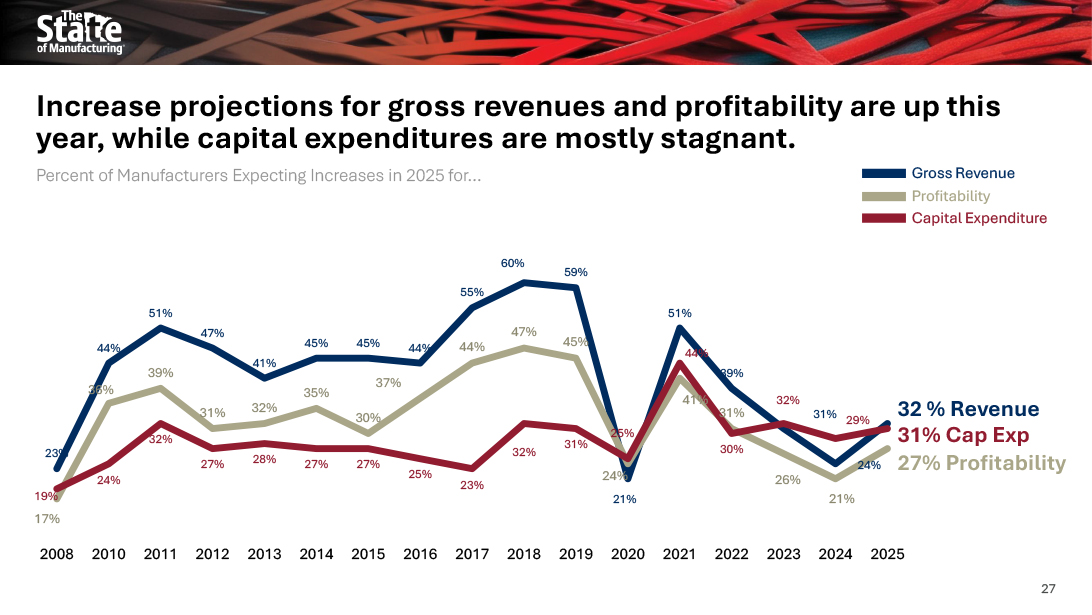

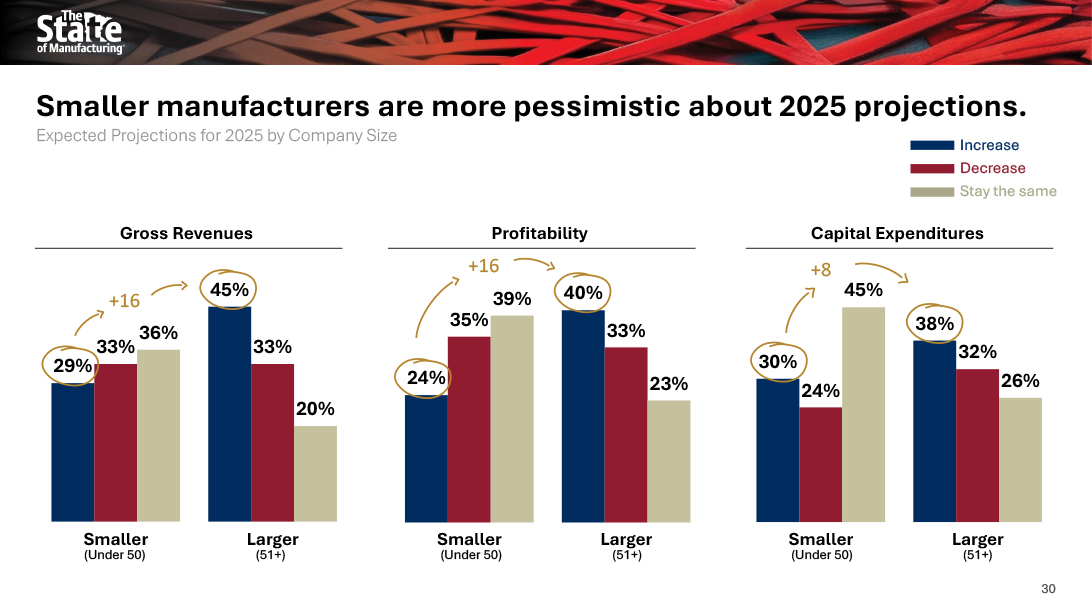

Expectations for gross revenues and profitability have improved modestly from last year’s downturn, but smaller manufacturers remain more pessimistic.

Facing New Headwinds

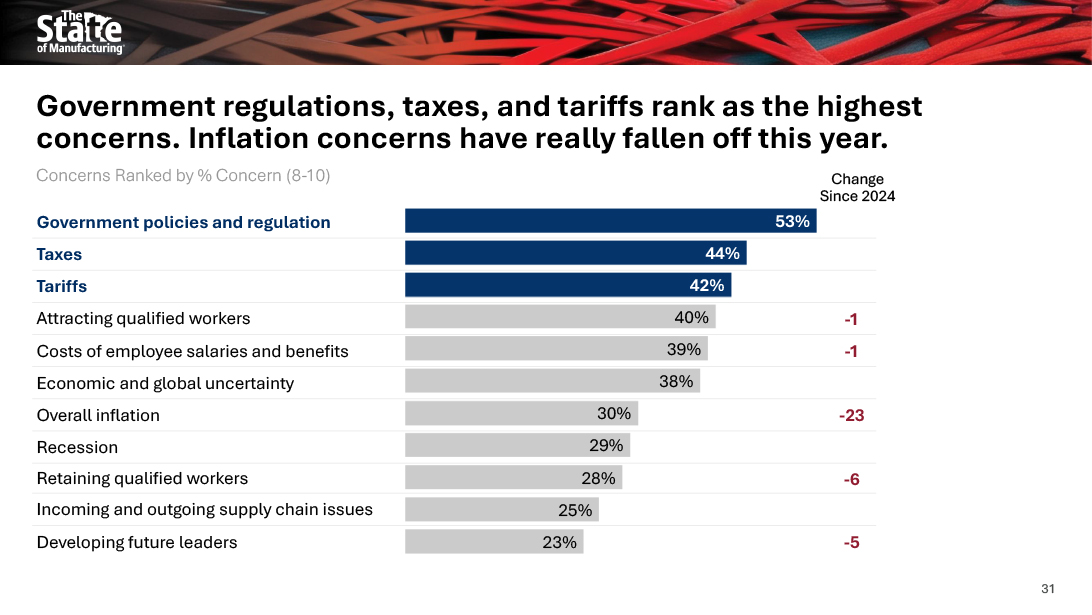

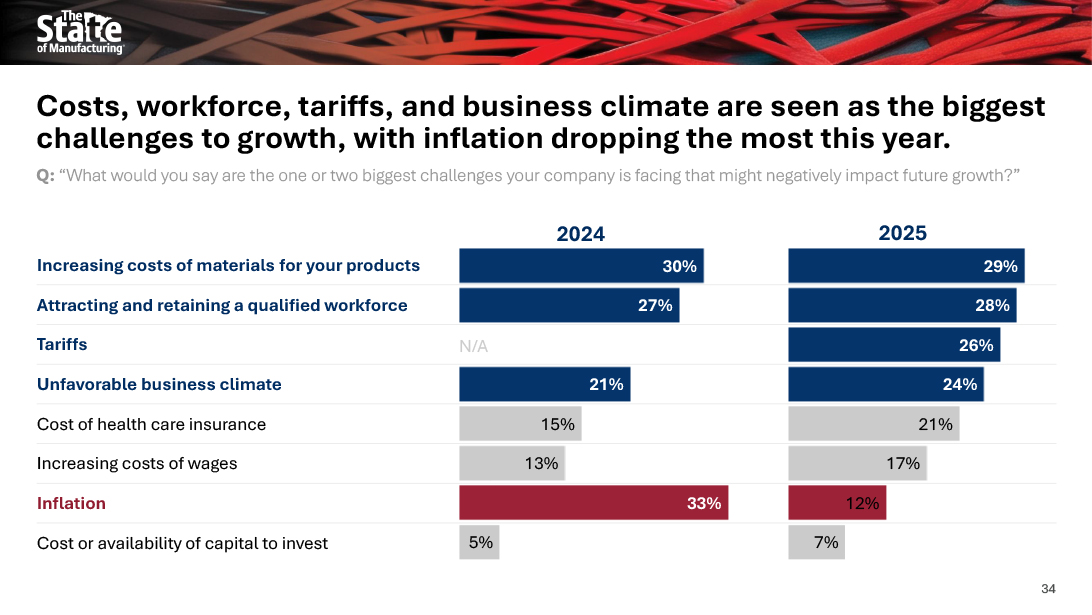

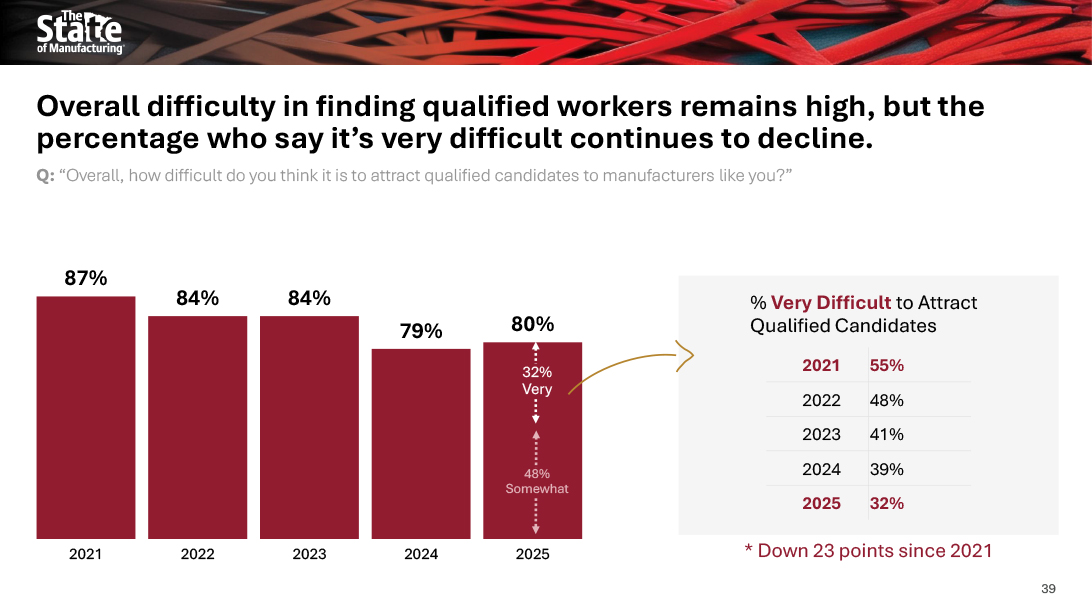

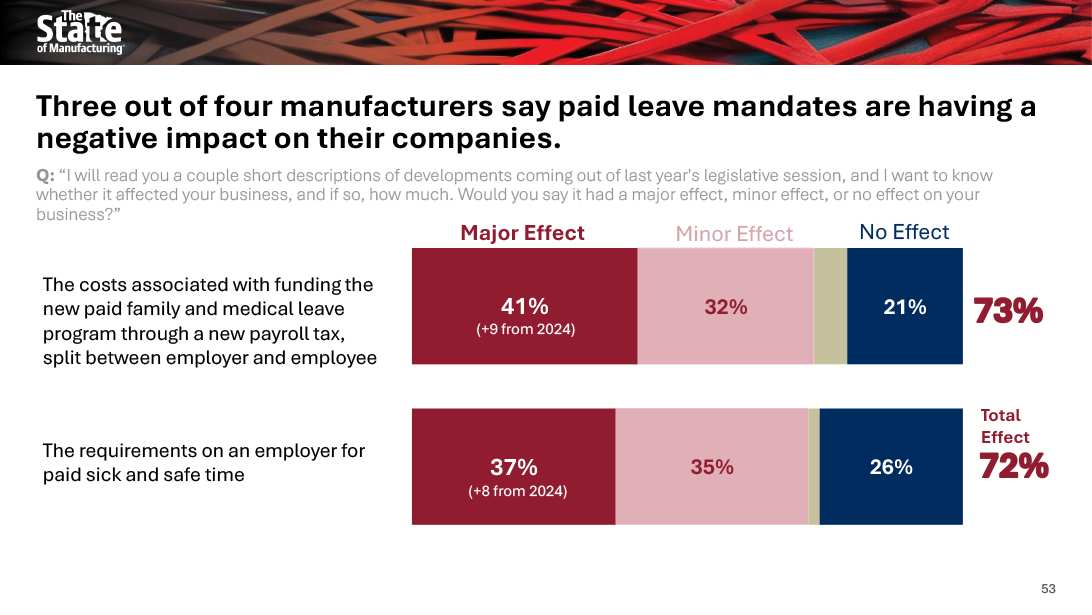

While workforce challenges remain, their intensity has declined to the lowest levels since the pandemic. Inflation concerns have also fallen sharply, replaced by worries over government policies, taxes, and tariffs, now the top three concerns among manufacturers.

Smaller companies continue to cite cost pressures, while larger manufacturers are more focused on regulatory burdens and what they see as an unfavorable business climate in the state.

Hope on a Short Leash

The overall tone in 2025 appears to be one of measured optimism. Economic confidence is back, inflation fears have cooled, and companies are cautiously re-engaging in planning and investment.

However, uncertainty regarding the state’s legislative and regulatory environment continues to serve as a drag on long-term confidence.

The Conversation Behind the Poll Numbers

Manufacturers use focus groups to discuss tariffs, the extensive new HR regulations, and the prospects of automation.

Requests for interview

Bob Kill, president & CEO of Enterprise Minnesota is available for comment and interview regarding the State of Manufacturing® survey. If you would like to schedule an interview, please contact Robert Lodge ([email protected]).

The State of Manufacturing survey is made possible through the support of our generous partners. If you are interested in being a part of the State of Manufacturing survey, please contact us.

The State of Manufacturing survey is conducted by Meeting Street Insights and is underwritten by Enterprise Minnesota.

Past Survey Results: Research & Data

Since 2008, the State of Manufacturing® survey has been providing industry-leading insight and analysis to business leaders, public policy makers, educators, and the media.