Minnesota manufacturers remain deeply pessimistic about the state’s overall business climate. In the 2025 State of Manufacturing® (SOM) survey, company leaders express strong concerns about new and recurring government-driven challenges, including state mandated programs like sick and safe time and paid leave. While manufacturers sense that the economy is rebounding and contributing to a more positive trajectory for their companies, concerns about government overreach dull their optimism.

The outlook among manufacturers about the overall economy this year is definitely tempered, says Bob Kill, president and CEO of Enterprise Minnesota.

“Yes, there has been a rebound in profitability and revenue growth, but capital expenditures are basically flat, and I see a concern underneath all of this that is brought on by the tariffs and family leave regulations,” Kill says. “This is not the Minnesota Miracle.”

Rob Autry, whose firm Meeting Street Insights has conducted Enterprise Minnesota’s survey since its launch in 2008, agrees that manufacturers have measured optimism this year about their industry and the economy. “There are a lot of concerns about the state’s legislative and regulatory environment that could serve as a drag on long-term confidence,” he says, adding that the overall mood is “cautiously better.”

Enterprise Minnesota’s annual SOM survey has taken the pulse of manufacturers since 2008. To gather insights from across Minnesota, pollster Meeting Street Insights conducts interviews with 400 randomly selected manufacturing executives, including owners, CEOs, CFOs, COOs, presidents, vice presidents, and managing officers. Respondents represent a broad mix of manufacturers by region, employee count, and annual revenue. In addition, the survey is paired with an oversampling of 50 executives in each of the six McKnight Initiative Foundation regions.

These efforts shed light on the latest trends in key business areas, ranging from economic confidence and workforce to growth and automation. The survey has a margin of error of ±4.9%. Enterprise Minnesota also complements the polling research with focus groups held each fall across the state. These groups convey deeper insights from manufacturing leaders about the pressing issues of the day. Combined, SOM provides a comprehensive view of this vital sector in Minnesota.

Nagging concerns about government overreach

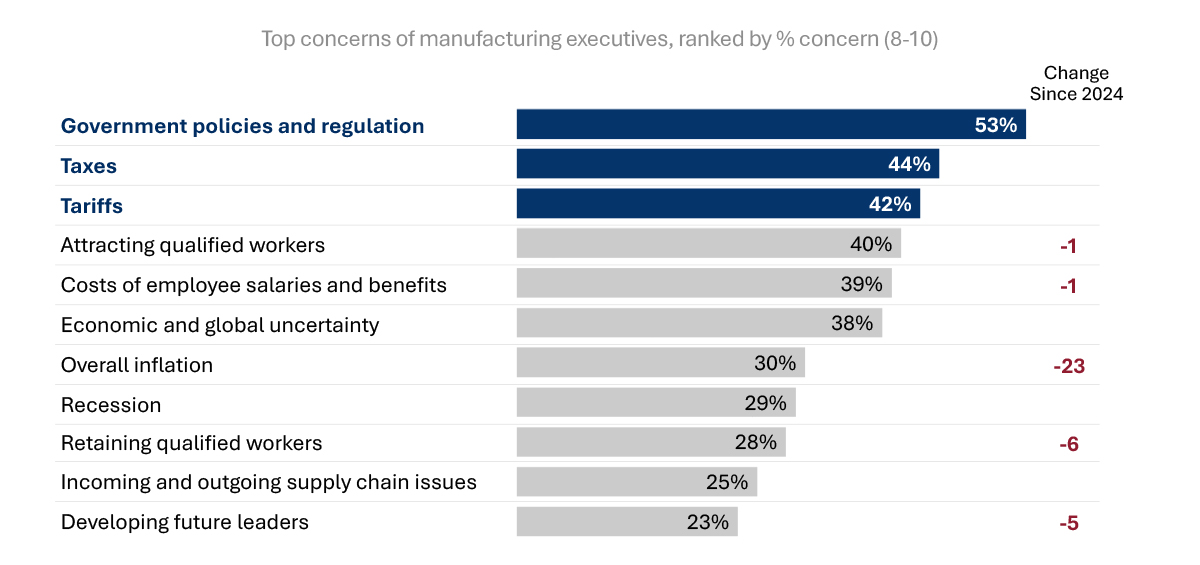

When looking at the state’s seven regions, including the Twin Cities, six listed government regulations as their top concerns. Only northwestern Minnesota cited taxes (66%) over government policies (50%). Taxes and tariffs were the most common second-place worries. Concerns about government policies peaked in northeastern Minnesota at 60%, closely followed by 59% in southwestern Minnesota.

“The concern about government policies and regulation is particularly important. Over half of manufacturers mentioned that, and it’s by far the number one concern,” Autry says.

“It’s a disconnect when you look at the economic numbers and the confidence they have in their own companies, but they see a worsening business climate. I think that’s being driven by the government regulations and policies in Minnesota,” Autry says.

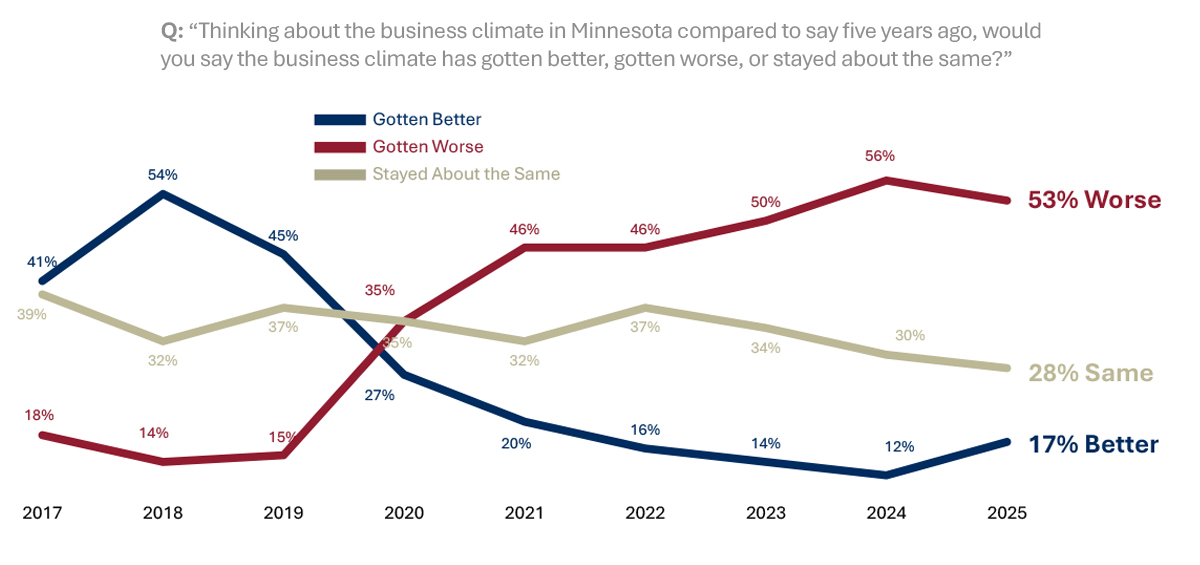

A consistent theme in the past five years is manufacturers’ sour view of the state’s business climate. It did improve slightly from last year, with 53% stating that Minnesota is a worse place to do business compared to 56% in 2024. Yet the overall trend is not positive. Since 2021, when 46% saw a worse business climate, there has been a rising consensus among manufacturing leaders that the overall business climate is not favorable.

“We still have a majority of manufacturers who believe that the business climate in Minnesota compared to five years ago is worse. Seventy percent say it’s a less attractive place to do business, and 46% of them say it’s much less attractive. That’s a really high number,” Autry says. “There is a sense that the economy is not doing as bad as it was a year or so ago, but that doesn’t mean that the business climate has gotten better.”

That perspective definitely came through in the fall focus groups. “The common denominator was that you don’t hear a positive thing about the Minnesota business climate,” Kill says. The new benefits requirements contribute strongly to manufacturers’ negative view of the Minnesota business climate. The sick time policy went into effect in 2024, and paid leave launches in January 2026.

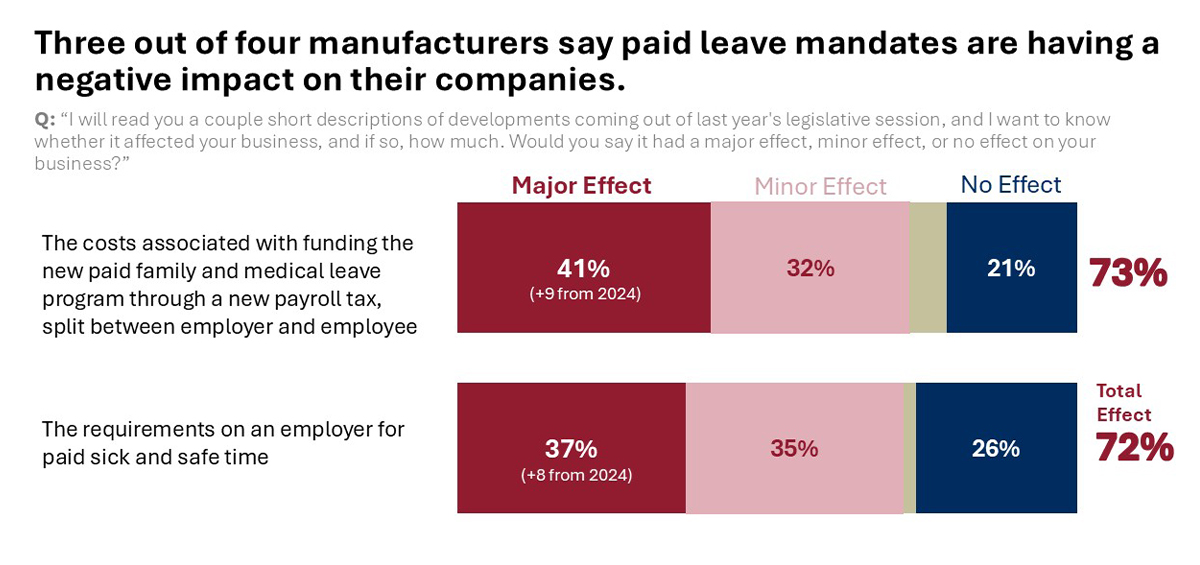

Manufacturing leaders don’t appreciate the new payroll taxes that support the paid leave program, or the administrative burdens and potential challenges of being left without key employees, Kill says.

In fact, there was a nine-point jump in manufacturers who report that the paid leave requirement will have a major impact on their businesses, from 32% in 2024 to 41% in 2025. There also was an eight-point increase in expected major impact for the sick time policy, jumping to 37%. In total, 73% of respondents believe that required paid leave will impact their business and 72% said the same of sick time.

Tariffs

Though fluctuating tariffs have been at play since the beginning of 2025, they aren’t alone among the top-ranked challenges manufacturers say might impact their future growth. Increasing costs of materials ranked highest (29%), followed by attracting and retaining a qualified workforce (28%), and then tariffs (26%). Inflation, the top challenge in 2024 at 33%, fell to the seventh biggest challenge at 12% in 2025.

Manufacturers of all sizes feel very confident about their ability to navigate the current tariff and trade environment. In total, 82% noted that they are confident, including 39% who are very confident. To handle the increased tariffs, 49% of respondents are passing the costs onto customers and 47% are increasing their sourcing from domestic suppliers. Others are adjusting their financial forecasts and budgets (38%) and stockpiling key materials (32%).

During focus groups, Kill heard a mostly even breakdown between manufacturers who have experienced a negative impact of tariffs, those who believe they can navigate tariffs, and leaders who don’t expect their companies to be affected. “There are some interesting winds in their face, but they are focusing on what they can control,” he says. “When manufacturers can control something, they feel very confident they can succeed. When there is something they can’t control, they start to pull back.”

Mixed messages

“Economic confidence is up, fears about inflation and recession are down, and executives are more optimistic about the future of their own companies,” Autry says. There are still headwinds, but they have shifted, moving away from inflation as the chief concern. Worries about inflation saw a significant drop — 23 points — from last year, when 53% of respondents cited it as their top concern. In 2025, respondents’ top three challenges are government regulations and policies (53%), taxes (44%), and tariffs (42%).

Company size plays a major role in manufacturers’ view of their biggest challenges. Businesses with more than $5 million in revenue have deeper concerns about government policies and regulations (60%) compared to companies with less than $1 million in revenue (39%). Similarly with tariffs, 36% of small manufacturers are worried compared to 47% of the larger companies. Smaller companies are most concerned about taxes at 49%, while taxes worry 43% of medium manufacturers with $1-$5 million in revenue and 42% of larger manufacturers.

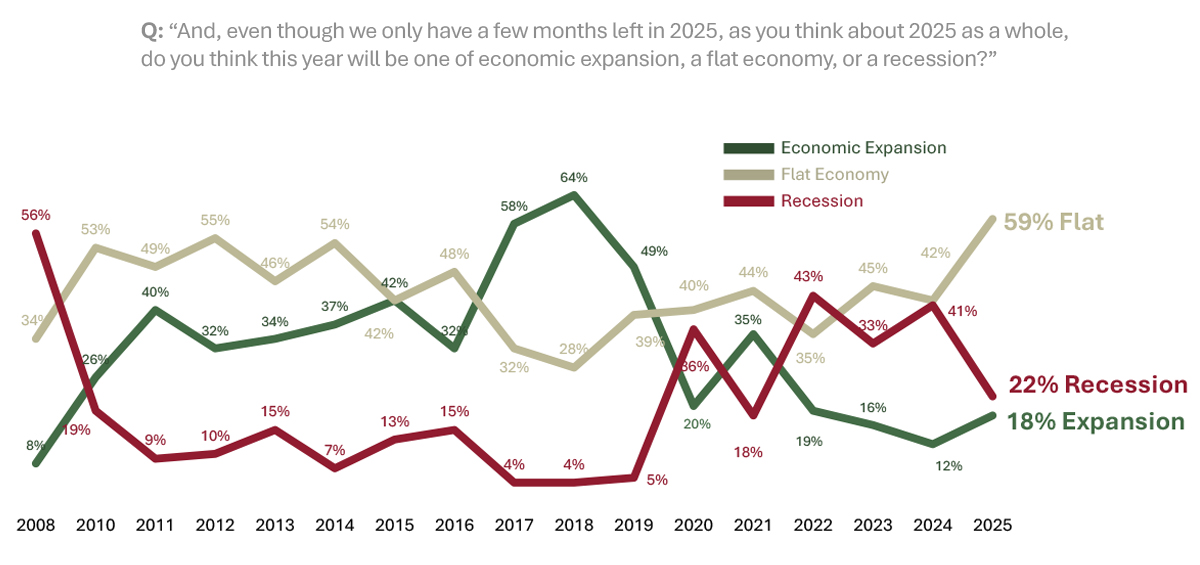

Manufacturers were highly concerned last year that the United States was heading toward economic trouble, with 41% bracing for a recession. This year, their fears about recession dropped 19 points to 22%. Instead, more manufacturers predict a flat economy for 2025, with 59% holding that view compared to 42% last year.

Looking at the economy for 2025 and 2026, manufacturers have increasing confidence that next year will be a time of economic expansion. More than double the respondents (37%) believe that the economy will be in expansion mode next year compared to this year’s 18%. In addition, manufacturers’ overall confidence in the future of their companies rose from 80% in 2024 to 87% this year.

When it comes to their own companies, manufacturers believe that 2025 will end on a good note on many measures. More respondents are anticipating increases in gross revenue at 32% compared to 24% last year. There has been a six-point jump in manufacturers who believe that their profitability will increase. But when it comes to capital expenditures, expected growth is essentially flat, with 31% expecting an increase, up from 29% in 2024.

While manufacturers overall are feeling more confident, it’s not a sentiment shared equally by manufacturers of all sizes. Comparing projections for gross revenue, 29% of businesses with less than 50 employees expect increased gross revenue. For large companies with more than 50 employees, 45% project an increase. Similarly, there is a 16-point difference in leaders’ views on whether their companies will be more profitable — 24% for smaller manufacturers and 40% for larger businesses. “It’s important to note that this optimism is coming more from bigger manufacturers,” Autry says. “Smaller manufacturers are not out of the woods yet.”

Hiring challenges ease

Manufacturers highlighted another area of improvement in 2025 — less struggling with hiring and retaining employees. Workforce concerns are at their lowest levels since COVID, Autry says, with the challenge of retaining workers listed at a historic low of 28%. Plus, concerns about hiring have declined 21 points since 2021 to 40% of manufacturers this year.

For 80% of respondents, it’s difficult to attract qualified candidates, although it’s not quite as tough as it was five years ago (87%). In addition, the number of manufacturers finding it very difficult to hire has declined. In 2021, 55% found it very difficult to attract qualified candidates compared to 32% this year.

One reason that hiring challenges have eased might be from manufacturers’ willingness to add more automation and turn to artificial intelligence to improve operations, Kill says. For the first time, manufacturers found automation and AI tools to be assets for their companies, appreciating they increase productivity and eliminate repetitive tasks.

At companies with more than 50 employees, 93% of respondents found positive impacts from automation. They find the tools effective for supporting data analysis and decision-making, enhancing scheduling and workflow efficiency, and automating repetitive or manual tasks. In comparison, 63% of companies with fewer than 50 employees saw positive impacts.

Impediments to adopting automation include high upfront investments or costs (48%) and difficulty with integrating the technology into their current systems (29%). Yet 27% of respondents noted that they did not face challenges. Developing an approach to adopting AI and automation is still a work in progress for most manufacturers, with 61% noting that they don’t currently have a strategy. In addition, 29% of manufacturers report that they are not currently considering adopting AI or automation tools.

Survey respondents also found value in public-private organizations like Enterprise Minnesota. In total, 80% agree that these organizations are important in helping them compete, grow, and remain competitive.

Return to the Winter 2025 issue of Enterprise Minnesota® magazine.