The same Minnesota manufacturers who have navigated the challenges of a COVID-era economy, unprecedented disruptions in their supply chains, and dwindling numbers of available workers are now preparing for yet another marketplace headwind: The likelihood that increased inflation will require continued interest rate hikes culminating in a full-blown recession.

The number of manufacturers who fear an upcoming recession has more than doubled over last year, according to the latest edition of Enterprise Minnesota’s State of Manufacturing® (SOM) survey, now in its 14th year. Since 2008, the SOM survey has kept a finger on the pulse of the state’s economic engine, interviewing hundreds of owners and executives in Minnesota’s manufacturing firms.

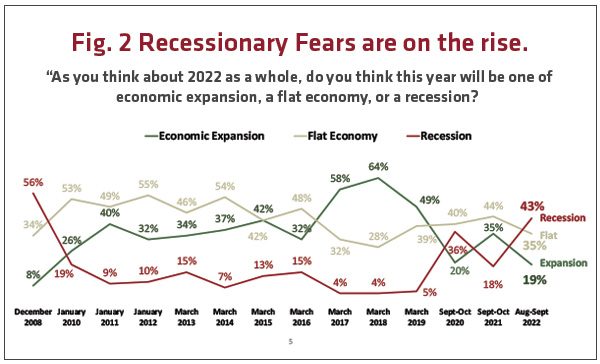

While just 18% anticipated a recession in 2021, 43% of respondents expect a recessionary economy in both 2022 and 2023. “That’s a big jump,” says Bob Kill, president and CEO of Enterprise Minnesota. “Even in 2020, in the midst of the pandemic, only 36% of respondents expected a recession.”

The number of manufacturers who fear an upcoming recession has more than doubled over last year

Kill suspects that the poll might actually understate manufacturers’ fears of recession because of the increased economic data released since the survey was conducted between mid-August and mid-September. “A lot changed in three to four weeks,” he says.

Pollster Rob Autry and his team at Meeting Street Insights, a research company based in South Carolina, interviewed a random sample of 400 Minnesota-based executives. Respondent titles included owners, CEOs, CFOs, COO, presidents, vice presidents and managing officers. The survey has a margin of error of +-4.9%.

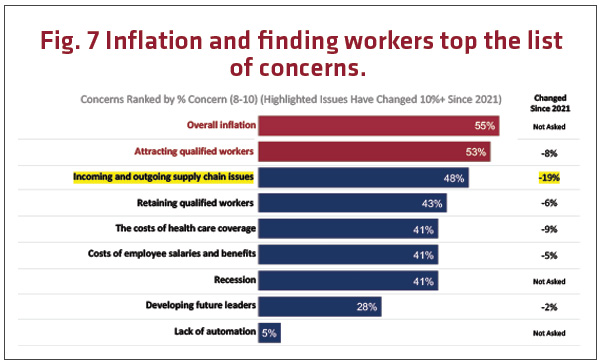

In addition to fear of recession, manufacturers’ top concerns are inflation and attracting qualified workers.

While maintaining a quality workforce is a perennial heartburn issue for executives, inflation entered the manufacturing world like a severe pop-up storm.

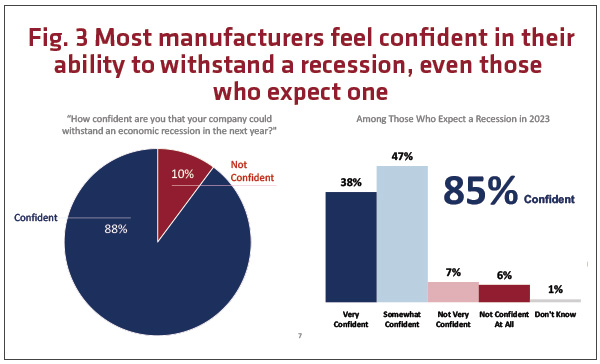

Despite pessimism about the broader economy, fully 88% of respondents say they are somewhat or very confident their company can withstand a recession. Confidence has been a hallmark of poll respondents since its inception.

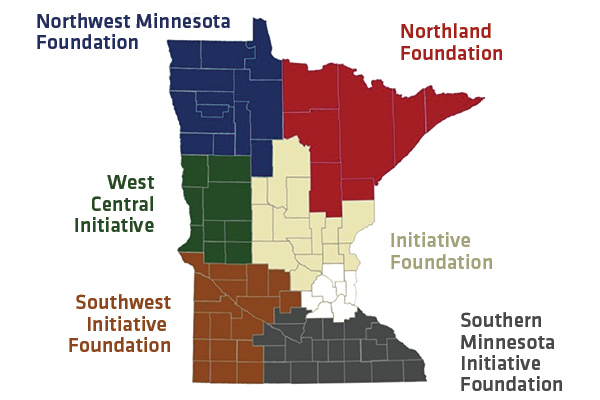

Autry added an “oversample” of 50 manufacturer interviews in each of the six Minnesota Initiative Foundation regions (shown in Figure 1). As in other years, Enterprise Minnesota conducted focus groups in-person and via Zoom with manufacturing leaders across the state.

Kill says these additional components of the State of Manufacturing research have been particularly helpful to understanding the results of this year’s survey. “Different regions of the state and different sizes and types of manufacturers are experiencing these challenges differently,” he says. “The regional oversample helps us understand those differences, while the focus groups tell us why manufacturers feel the way they do.”

Cost concerns

This year inflation led the list of worries for manufacturers, with 55% of respondents citing it is a concern. Inflation did not make the list last year, when supply chain issues were the top concern, with 67% listing it as a worry then. Supply chain issues fell 19 points, to 48% this year.

Respondents outside the metro area expressed the greatest concern about inflation, with 72% in the northwest region and 65% in the west central region listing it as their top issue.

Smaller companies — both those with lower revenues and fewer employees — expressed the most concern about rising material costs. When asked to list the one or two biggest challenges facing their company, 50% of those with less than $1 million in revenue listed increasing material costs, as did 48% of those with fewer than 50 employees.

Storm clouds brewing

Only 19% of manufacturers say 2022 will be a year of expansion, while 43% expect recession and 35% predict flat growth for the year. Looking ahead, the numbers are equally pessimistic, with 43% anticipating recession, 34% expecting flat growth and 19% predicting expansion.

Fears of recession rose dramatically from last year, when just 18% of respondents saw a recession on the horizon, 35% predicted economic expansion, and 44% anticipated flat growth. Perhaps more telling, just 36% of respondents in the 2020 survey expressed a fear of recession.

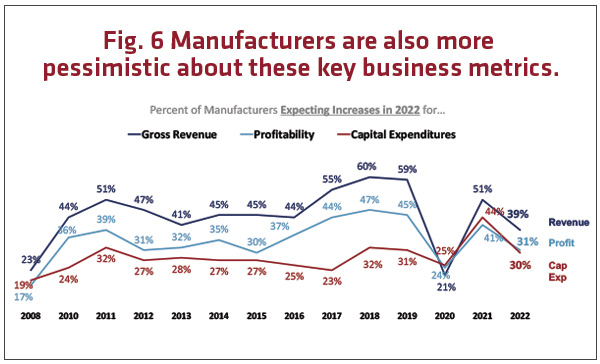

Respondents also indicated less optimism about future revenues, profits and capital expenditures. While not falling back to 2020 levels, these key business metrics fell considerably from the 2021 survey. Only 39 percent of respondents expect increased revenue for 2022, dropping from 51% in 2021. Those who think profits will increase this year fell to 31%, from 41% last year. Respondents anticipating growth in capital expenditures fell from 44% to 30% this year.

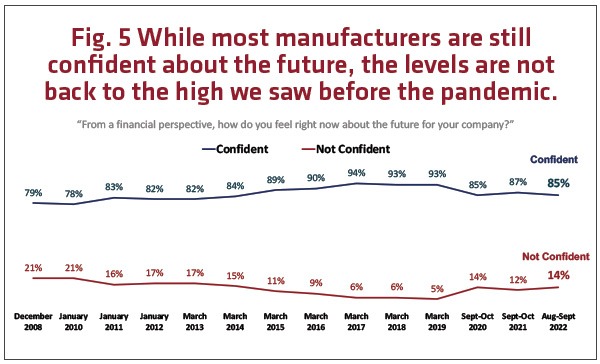

At the same time, manufacturers are still confident about the future, with 85% reporting confidence in the financial future of their companies. Smaller companies are less optimistic overall, with 75% reporting confidence, while 96% of respondents from larger companies say they are confident about their firm’s future.

Workforce worries

Attracting qualified workers remains a pressing issue to all respondents. While down from last year’s figure of 61%, 53% of respondents continue to name it as a top concern.

More than half of companies currently have open positions or are hiring, and of those, 84% find it somewhat or very difficult to attract qualified candidates.

The difficulties in hiring are impacting metro area and Greater Minnesota companies equally, but larger companies — measured by both revenue and number of employees — listed attracting and retaining a qualified workforce as their top concern by wide margins.

Among manufacturers with more than $5 million in revenue, 69% listed attracting and retaining quality employees as their top concern, and those with over 50 employees (64%) said attracting and retaining good employees was a top concern.

The largest companies also have more vacancies and are having more difficulty filling them. Fully 91% of those with more than $5 million in revenue are looking for workers and finding hiring difficult. Of those with more than 50 employees, 89% report they are hiring, and 85% of those are finding it difficult.

Being known for a great work environment overall is a top priority for companies of all sizes, but offering competitive salaries and providing a safe work environment is more important to large companies.

After years of health care costs ranking among top issues of concern, this issue fell to fifth, with 41% of respondents listing it as a worry.

Challenges to growth

Workforce challenges and increasing costs tied as the biggest challenges to growth for respondents. Both issues were listed by 44% of manufacturers as one or two of the biggest challenges to growth.

Cost issues combined to round out the rest of the five issues, with inflation at 25%, increasing costs of wages at 13% and the cost of health insurance at 12%.

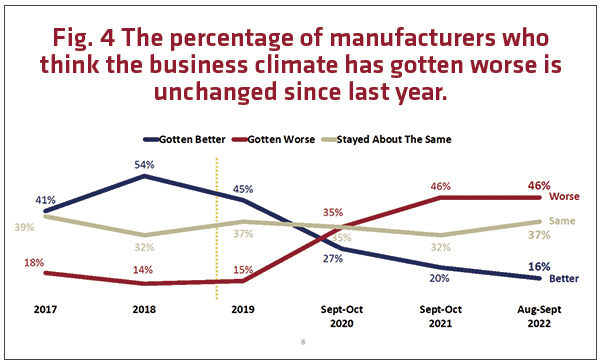

The percentage of manufacturers who say the state’s business climate has gotten worse over the last year ties with last year, at a stunning 46%.

Looking ahead

A stunning 63% of those surveyed expect to increase investment to manage costs due to inflation. Respondents who plan to invest in growing revenue and profitability totaled 54%, while those who plan to invest in maximizing productivity hit 51%.

Respondents who plan to invest in growing revenue and profitability totaled 54%, while those who plan to invest in maximizing productivity hit 51%.

The percentage of manufacturers who have a formal strategic plan is down to its lowest level since 2016, dropping from 55% last year to 48% this year.

On the other hand, more manufacturers have a succession plan for senior leadership in place, up from 43% who had such a plan last year.

Among small manufacturers — those with less than $1 million in revenue — just 26% have a formal strategic plan. This number goes up to 50% for those with $1 million-$5 million in revenue, and for companies with more than $5 million in revenue, 75% report having a formal strategic plan.

Cybersecurity

Manufacturers continue to be relatively unconcerned about cybersecurity, despite nearly a fifth reporting that they, or a company they work with, have experienced a cyberattack of some kind.

The largest companies — those with more than $5 million in revenue — are the most likely to have experienced a data breach, with 29% reporting a hack. Among those with less than $1 million in revenue, only 9% have experienced a hack.

Among all respondents, 88% say they are confident their company is secure from hacking, data breaches and other technological threats. At 94%, the largest companies are most likely to report confidence that they are secure from a breach; 79% of the smallest companies share that confidence.

For companies that have taken action to protect against cyber threats, the most common step, for 64% of respondents, was upgrading technology. In addition, 38% have added employee training to prevent hacks, and 26% report having insurance policies that cover a cyberattack.

…

Featured story in the Winter 2022 issue of Enterprise Minnesota magazine.